Have you ever wondered if a leased car counts as an asset? It’s a question that can affect your finances, credit, and even your future buying power.

Understanding the true value of a leased vehicle can help you make smarter decisions about your money. You’ll discover what makes something an asset and where your leased car fits in. Keep reading to clear up the confusion and take control of your financial choices.

Leased Cars In Financial Terms

Understanding leased cars in financial terms helps clarify their true value. Many people wonder if a leased car counts as an asset or a liability. Knowing the basics of assets and liabilities is key. It also helps to understand how leasing works.

Asset Vs Liability Basics

An asset is something you own that has value. It can bring future benefits or income. A liability is a financial obligation you owe. It often means money you must pay back. A leased car is not owned by you. It remains the property of the leasing company. This means it is not an asset on your personal balance sheet. Instead, lease payments are expenses or liabilities. They reduce your available money over time.

How Leasing Works

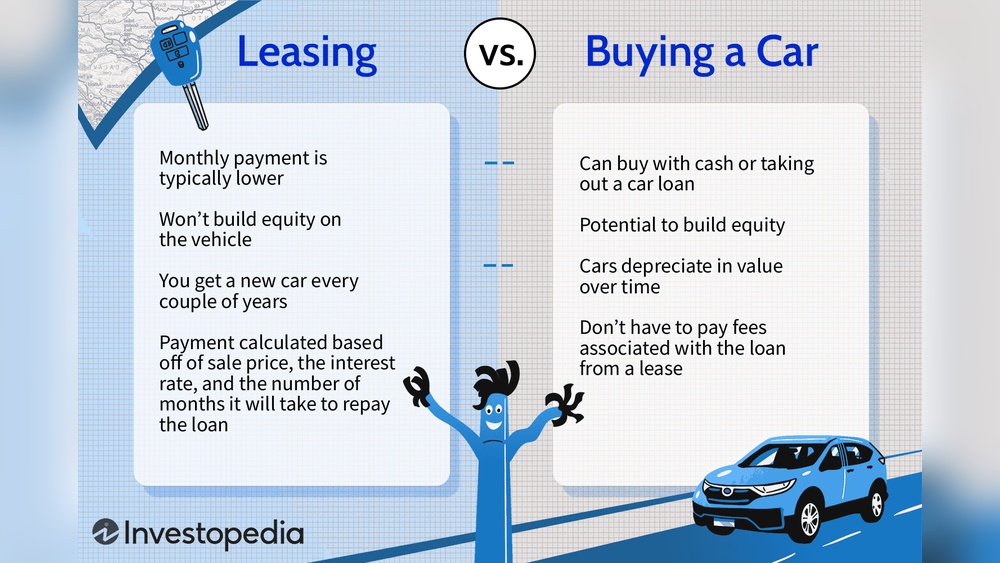

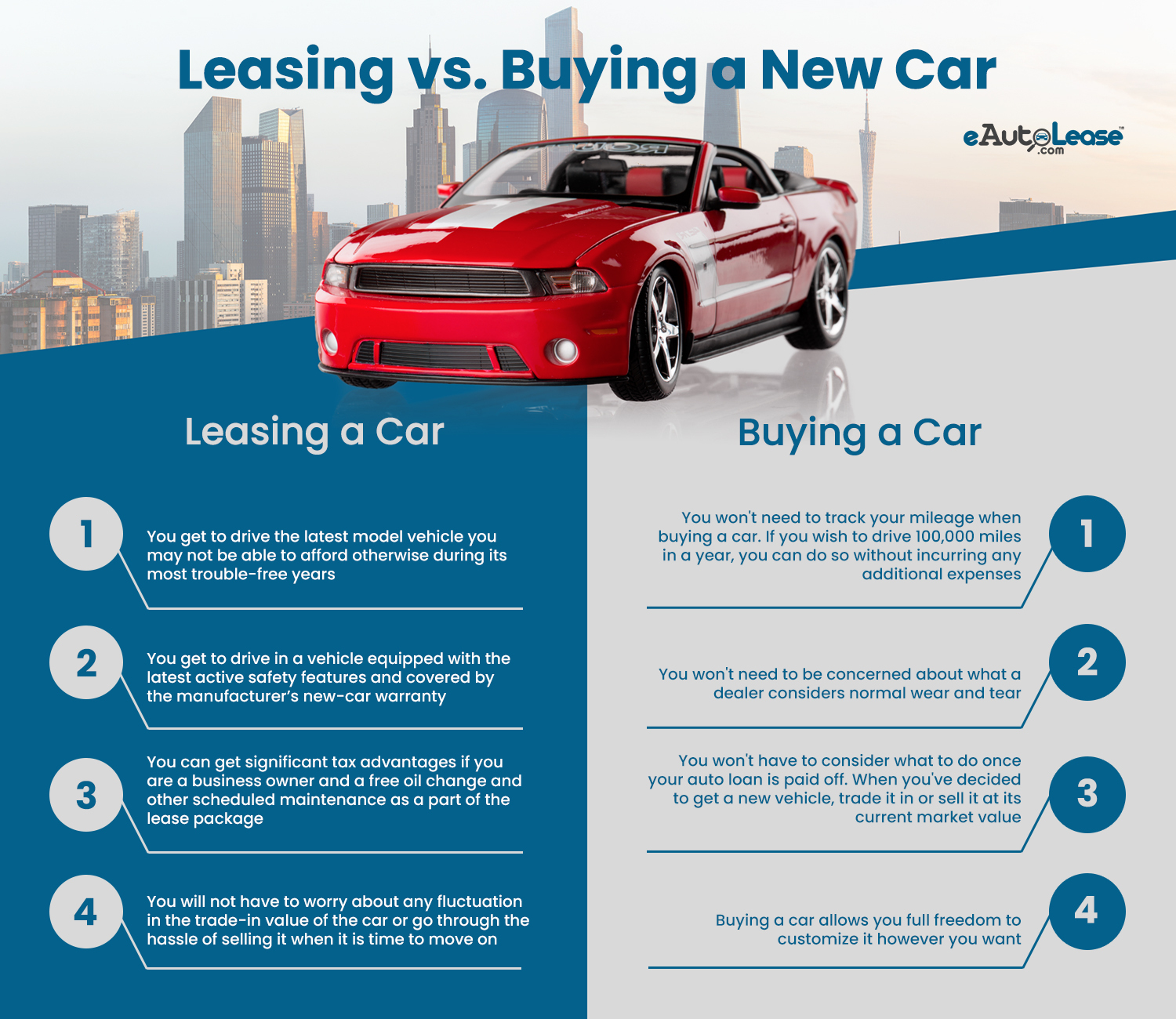

Leasing a car means you pay to use it for a set time. The leasing company owns the vehicle. You agree to return the car at the end of the lease. Monthly payments cover the car’s depreciation and use. You do not build ownership or equity in the car. Leasing often requires lower monthly payments than buying. But you cannot sell or keep the car after the lease ends. This limits the financial benefits of ownership.

Credit: www.esseg.eu

Accounting For Leased Vehicles

Accounting for leased vehicles can be tricky. It depends on how the lease is structured. The rules affect how the vehicle appears in financial records. It also influences the company’s reported assets and liabilities.

Understanding these accounting rules helps businesses keep accurate books. It also helps in making better financial decisions. Let’s explore how leased vehicles impact accounting statements.

Balance Sheet Impact

Leased vehicles may or may not appear on the balance sheet. This depends on the lease type. For certain leases, the vehicle is recorded as an asset. A corresponding liability is also recorded.

This shows the right to use the vehicle and the obligation to make payments. The asset is called a “right-of-use” asset. It reflects the value of using the vehicle over time. This treatment affects key financial ratios and company value.

Lease Classification Effects

Leases fall into two main categories: operating and finance leases. Finance leases are treated like asset purchases. The vehicle and liability are recorded on the balance sheet. Depreciation and interest expenses are recorded separately.

Operating leases are treated like rental agreements. Payments are recorded as expenses in the income statement. The vehicle does not appear as an asset or liability. This classification affects reported profits and asset levels.

Financial Benefits Of Leasing

Leasing a car offers several financial benefits that appeal to many drivers. It lets you use a new vehicle without paying the full price upfront. This can help you manage your money better and avoid large debts. Understanding these benefits helps decide if leasing suits your financial needs.

Cash Flow Advantages

Leasing keeps your monthly payments lower than buying a car. This saves cash for other important expenses. You avoid large down payments that buying a car usually needs. Leasing also reduces repair costs because new cars often come with warranties. This means fewer unexpected expenses over time.

Tax Implications

Leasing may offer tax benefits, especially for businesses. Lease payments can sometimes be deducted as a business expense. This lowers the taxable income and reduces overall tax bills. Personal users might not get the same benefits but should check local tax rules. Knowing these details can help you save money legally.

Limitations Of Leased Cars As Assets

Leased cars often confuse people about their value as assets. Unlike owned vehicles, leased cars come with limits that affect their asset status. Understanding these limits helps clarify why leased cars may not be true assets for many.

Depreciation And Ownership

Leased cars lose value over time, just like owned cars. But you do not own a leased car. You only pay for its use during the lease term. This means you cannot sell or keep the car after the lease ends. Depreciation affects the car, but you do not benefit from any remaining value.

Equity Considerations

Equity means the value you own after paying off debts. With leased cars, you build no equity. Monthly payments go to the leasing company, not to owning the car. At lease end, you have no asset to show for your payments. This limits financial benefits that come with true ownership.

Comparing Leasing To Buying

Deciding between leasing and buying a car affects your finances and ownership. Both options have clear benefits and drawbacks. Understanding these can help you choose what fits your needs best.

Cost Analysis Over Time

Leasing usually means lower monthly payments than buying. You pay for using the car, not owning it. Buying requires higher payments but builds ownership. Over several years, buying can be cheaper if you keep the car long. Leasing costs add up if you lease repeatedly. You avoid big repair costs with leasing since the car is newer. Buying may lead to more repair bills as the car ages. Consider your budget and how long you want the car.

Flexibility And Risk

Leasing offers flexibility to drive a new car every few years. Lease contracts limit mileage and may charge for wear. Buying gives freedom to use the car as you like. You can sell or modify a bought car anytime. Leasing avoids the risk of a car losing value. Buying means you bear the risk of depreciation. Ending a lease early can be costly. Selling a bought car is easier if needs change. Think about your driving habits and future plans.

Credit: www.liftingitalia.com

When Leasing Makes Sense Financially

Leasing a car can be smart for some people and businesses. It can save money and avoid big costs upfront. Knowing when leasing makes sense helps you decide if it fits your money plans. This section explains key points about leasing in financial terms.

Business Use Cases

Businesses often lease cars to keep cash flow steady. Leasing avoids large payments that reduce working capital. It helps companies update vehicles regularly without selling old ones. Tax benefits may apply, lowering overall costs. Leasing can also simplify budgeting with fixed monthly payments. It fits well for employees who need cars for work.

Personal Finance Factors

Leasing suits people who want lower monthly payments. It helps avoid big down payments and high repair costs. Leasing can keep monthly expenses predictable and manageable. It works for those who drive less and prefer new models. People who dislike long-term commitments may find leasing better. Leasing is ideal when you want a car for a short time.

Credit: www.esseg.eu

Frequently Asked Questions

Is A Leased Car Considered A Financial Asset?

A leased car is not a financial asset since you do not own it. You only have the right to use it during the lease term.

How Does Leasing Affect Your Net Worth?

Leased cars do not increase your net worth as they are not owned assets. Lease payments are considered expenses, not investments.

Can You Sell A Leased Car To Others?

No, you cannot sell a leased car because the leasing company holds ownership rights. You must return it after the lease ends.

Does Leasing A Car Build Equity?

Leasing a car does not build equity. You pay for use, not ownership, so no asset value accumulates over time.

Conclusion

A leased car is not truly an asset you own. It offers use but no ownership rights. Monthly payments are like rent, not investment. You avoid depreciation costs but gain no resale value. Leasing suits those who want flexibility and lower upfront costs.

Owning a car builds equity over time. Think carefully about your financial goals before choosing. Leasing or buying depends on your needs and situation. Decide what fits best for your lifestyle and budget.

Recent Posts

Tired of wrestling with your chains in the freezing cold? Discover how auto-fixing snow chains tighten themselves, giving you the ultimate effortless grip for a safer winter drive.

Struggling with that stubborn, hazy film on your car's glass? Discover the best oil film removers that will give you flawless, crystal-clear vision for a safer drive.