Wondering how much car insurance will cost you? You’re not alone.

Finding the right coverage without breaking the bank can feel confusing and overwhelming. But what if you knew exactly what affects your rates and how to save money? This article will break down everything you need to know about car insurance costs in simple terms.

By the end, you’ll feel confident making smart choices that protect your car and your wallet. Keep reading to discover the secrets to affordable car insurance tailored just for you.

Factors Affecting Car Insurance Costs

Car insurance costs vary widely due to several key factors. Understanding these factors helps drivers estimate their premiums better. Each element plays a role in how insurers calculate risk and price policies. Below are the main factors affecting car insurance costs.

Driver’s Age And Experience

Young and new drivers usually pay higher premiums. Insurance companies see them as higher risk. Older, experienced drivers often get lower rates. Safe driving habits over time reduce costs.

Vehicle Type And Model

Expensive and powerful cars often cost more to insure. Luxury and sports cars have higher repair costs. Small, older cars tend to have lower premiums. Safety features in a vehicle can lower insurance costs.

Location And Driving Environment

Urban areas with heavy traffic increase insurance prices. High crime rates in a region also raise costs. Rural areas usually offer cheaper insurance. Road conditions and accident rates influence premiums too.

Driving History And Record

Clean driving records lead to lower insurance costs. Accidents, tickets, or claims increase premiums. Insurers reward safe and careful drivers. Past claims history impacts future rates significantly.

Coverage Types And Limits

Higher coverage limits raise the cost of insurance. Adding extras like comprehensive or collision coverage adds fees. Choosing minimal coverage lowers premiums but increases risk. Balance coverage needs with budget for best results.

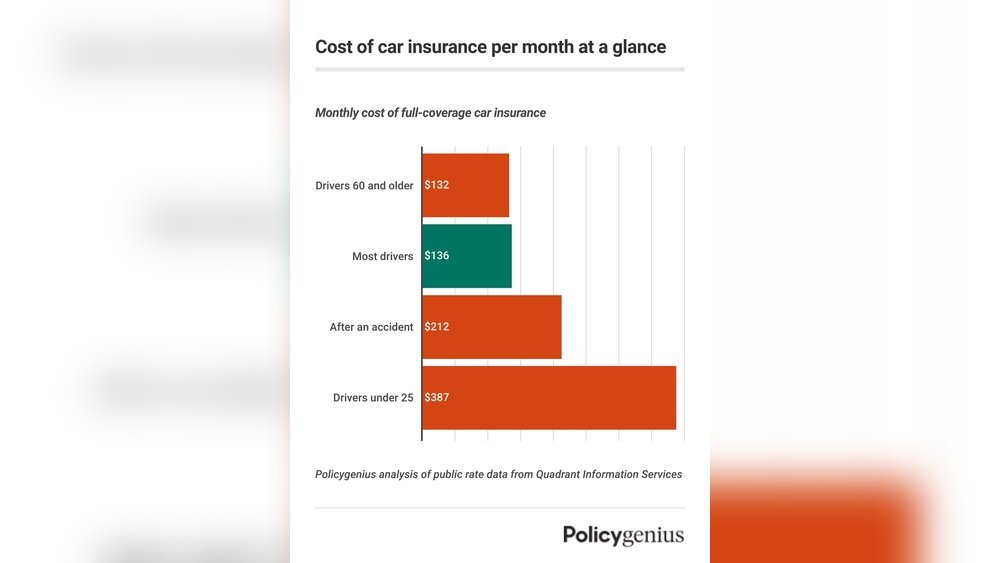

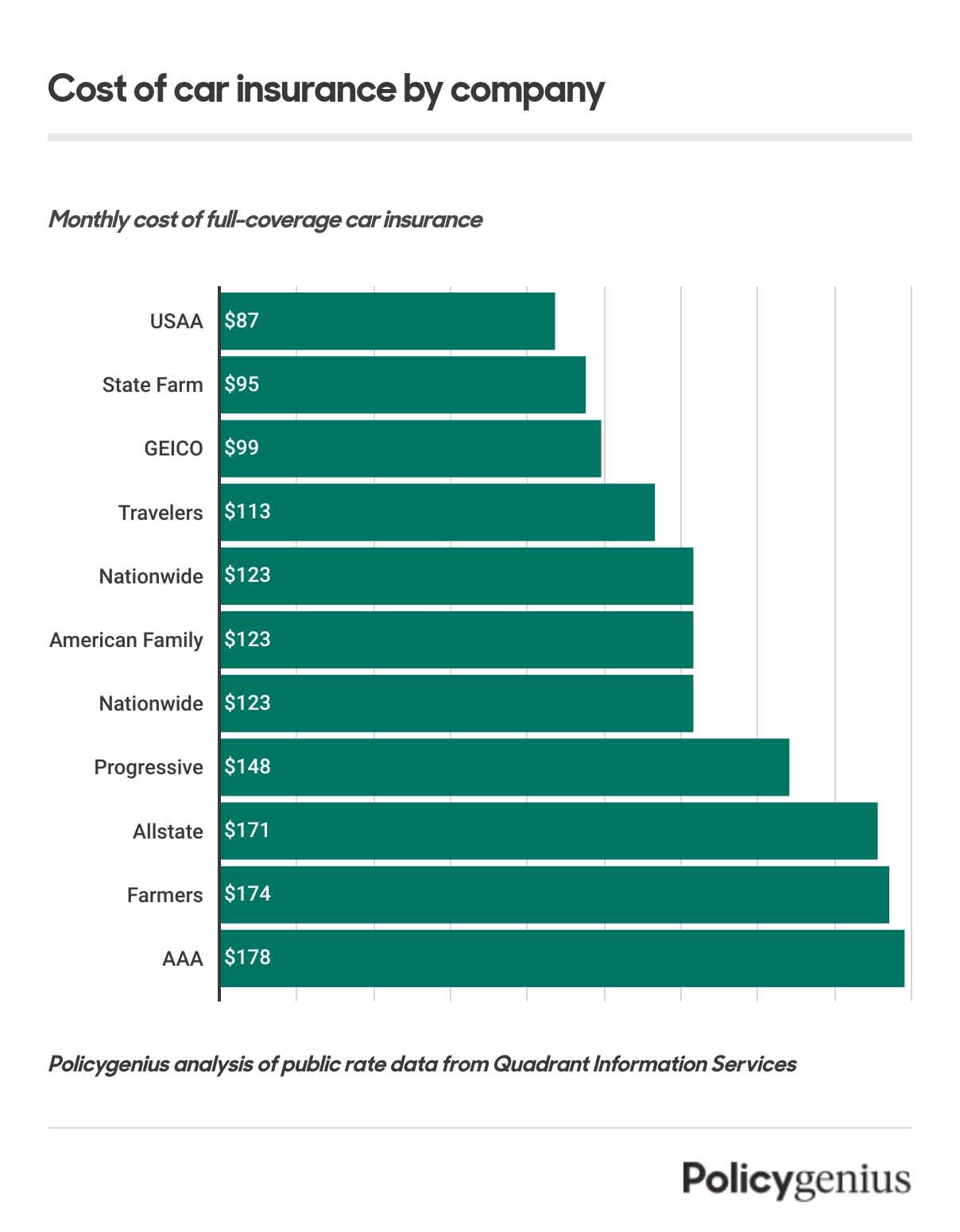

Credit: www.policygenius.com

Types Of Car Insurance Coverage

Car insurance has many coverage types. Each type protects you in different ways. Knowing these types helps you choose the right plan. It also shows how costs can vary. Here are the main car insurance coverages.

Liability Coverage

Liability coverage pays for damage you cause to others. It covers injuries and property damage. This coverage is often required by law. It does not pay for your own injuries or car damage.

Collision Coverage

Collision coverage pays for damage to your car. This applies after a crash with another vehicle or object. It helps fix or replace your car. You usually pay a deductible first.

Comprehensive Coverage

Comprehensive coverage protects against non-crash damage. Theft, fire, vandalism, and natural disasters are included. It covers repair or replacement costs. It also often requires a deductible.

Personal Injury Protection

Personal Injury Protection (PIP) covers your medical costs. It also helps pay for lost wages. PIP works even if you caused the accident. It can cover passengers too.

Uninsured Motorist Coverage

This coverage protects you from drivers without insurance. It pays for your medical bills and car repairs. It can cover hit-and-run accidents as well. Uninsured motorist coverage is important in many states.

Average Car Insurance Costs

Understanding the average cost of car insurance helps you budget better. Insurance rates vary widely across the country and depend on many factors. Knowing these averages gives you a clearer picture of what to expect.

National And Regional Averages

The average annual car insurance cost in the U.S. is about $1,500. Some states have higher rates due to traffic and accident risks. For example, Michigan and Louisiana often have costs above $2,000. States like Maine and Idaho tend to be cheaper, with rates under $1,000.

Urban areas usually face higher insurance costs than rural areas. More cars mean more accidents and claims. This raises the price of insurance in cities.

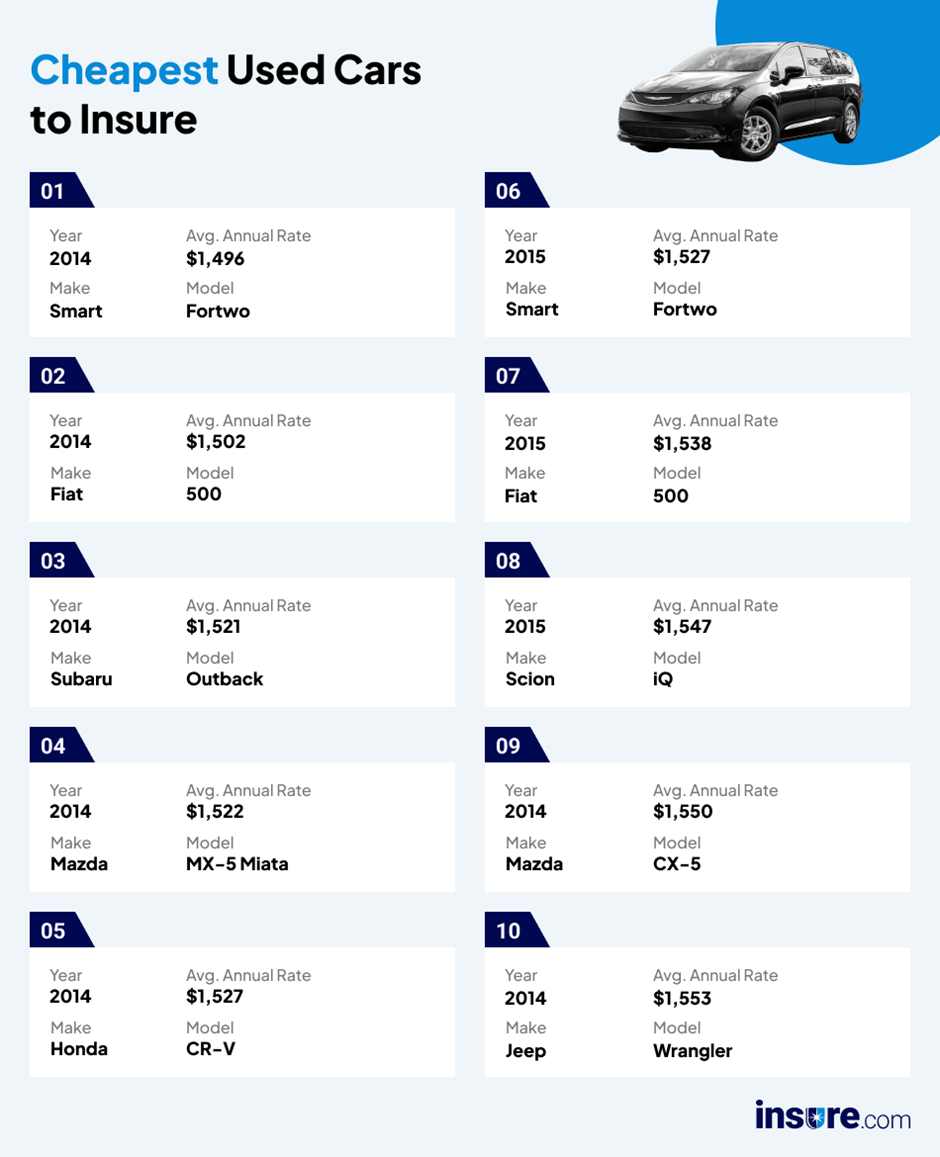

Cost Differences By Vehicle Type

Insurance rates also change based on the type of vehicle you drive. Sports cars and luxury vehicles often cost more to insure. They have higher repair costs and theft rates.

Sedans and family cars usually have lower insurance premiums. They are cheaper to repair and safer to drive. Older cars may cost less to insure but check if coverage is enough.

Impact Of Coverage Choices

Your choice of coverage affects your insurance cost a lot. Basic liability coverage is cheaper but offers limited protection. Full coverage, including collision and comprehensive, costs more.

Higher deductibles lower your premium but increase out-of-pocket costs after an accident. Adding extras like roadside assistance or rental car coverage raises your price. Choose coverage that fits your needs and budget carefully.

Ways To Lower Your Insurance Premiums

Lowering car insurance premiums helps save money each month. Simple steps can reduce costs without losing coverage. These tips help control your budget and keep your insurance affordable.

Choosing Higher Deductibles

A deductible is the amount paid before insurance helps. Picking a higher deductible lowers your premium. This means more out-of-pocket cost if you have a claim. Choose carefully based on your savings and risk.

Bundling Policies

Many insurers offer discounts for bundling. Combine car insurance with home or renters insurance. Bundling saves money and simplifies bill payments. Always compare bundled rates to single policy costs.

Maintaining A Clean Driving Record

Safe driving reduces accident chances and insurance costs. No traffic tickets or accidents keeps premiums low. Insurance companies reward drivers with clean records. Drive carefully and follow traffic rules.

Taking Advantage Of Discounts

Insurance companies provide many discounts. Examples include good student, low mileage, or safety features. Ask your insurer about all available discounts. Even small savings add up over time.

Improving Credit Scores

Credit scores affect insurance premium rates. Better credit scores often lead to lower premiums. Pay bills on time and reduce debt. Check your credit report regularly for errors.

Shopping For The Best Car Insurance

Shopping for the best car insurance takes time and care. You want the right coverage at a price that fits your budget. Many options exist, so knowing how to compare and choose helps you save money and get good protection.

Focus on important steps. They include comparing quotes, checking insurer reputation, understanding policy details, and using brokers.

Comparing Quotes Online

Start by collecting quotes from different insurance companies. Online tools make this fast and easy. Enter your details once, then see multiple offers. Look at prices side by side. Notice the coverage each quote includes. Cheaper is not always better. Choose a balance of cost and coverage.

Evaluating Insurer Reputation

Check customer reviews and ratings. A good insurer pays claims quickly and treats customers well. Look at complaint records and financial strength scores. A stable company is more reliable. Avoid insurers with many negative reports. Peace of mind matters when you need help.

Understanding Policy Terms

Read the policy carefully. Know what is covered and what is not. Watch for limits and deductibles. These affect how much you pay in a claim. Understand exclusions and special conditions. Clear knowledge avoids surprises later. Ask questions if anything is unclear.

Using Insurance Brokers

Brokers can help find the best deals. They know the market and have access to many insurers. Brokers explain terms in simple words. They help customize coverage for your needs. Using a broker can save time and stress. Make sure the broker is licensed and trustworthy.

Credit: www.insure.com

Common Myths About Car Insurance Costs

Many people have wrong ideas about car insurance costs. These myths can make you confused. Understanding the truth helps you choose the best insurance without extra costs.

Age And Gender Misconceptions

Some believe young drivers always pay more. Age affects rates but not alone. Safe driving records matter more. Gender does not decide your premium. Insurers focus on risk, not stereotypes.

Claims Affecting Premiums

People think making claims always raises costs. Small claims may not change your premium. Frequent or large claims can increase rates. Honest reporting helps keep coverage steady.

Impact Of Car Color

Many say car color changes insurance cost. Color does not affect your premium. Insurers care about car model and safety. Choose color for style, not price.

- 【Quality Material】The insurance and registration holder is crafted using high quality, soft, eco-friendly pu leather wit…

- 【Lightweight and Portable】Measuring 5.0 inches x 9.4 inches x 0.4 inches, car insurance and registration card holder is …

- 【Easy Access】insurance card holder for car of the holder is carefully designed with clear PVC inner pockets for easy rea…

Tips For Filing Claims Without Raising Costs

Filing a car insurance claim can feel stressful. It may also affect your insurance cost. Knowing how to file claims wisely helps you avoid higher premiums. This section shares tips to keep your costs low while using your coverage.

When To File A Claim

File a claim only for damages that are costly. Small repairs might be cheaper to pay yourself. Check your deductible. If the repair cost is less than the deductible, don’t file. Also, consider how serious the accident was. Injuries or major damage need a claim. Minor fender benders might not.

How Claims Affect Premiums

Insurance companies review your claims history to set your rate. More claims can mean higher premiums. Some claims cause bigger increases than others. At-fault accidents often raise your cost more. Claims for comprehensive damage, like theft or weather, may not impact as much. Avoid filing claims for small amounts to keep your premiums stable.

Working With Adjusters

Adjusters inspect your vehicle and damage. Provide them with clear, honest information. Take photos of the damage before repairs. Be polite and cooperative to speed up the process. Ask questions if you do not understand. Keep notes of all conversations and documents. This helps avoid mistakes that could increase costs.

Credit: www.nasdaq.com

Frequently Asked Questions

What Factors Affect Car Insurance Costs The Most?

Car insurance costs depend on factors like driver age, vehicle type, location, driving history, and coverage level. Insurers assess these to set premiums. Safer drivers with newer cars usually pay less. High-risk areas or poor credit can increase costs. Understanding these helps find affordable insurance.

How Much Does Car Insurance Cost On Average?

The average car insurance cost in the U. S. is about $1,500 per year. Prices vary widely based on location, coverage, and driver profile. Some may pay as low as $600 annually, while others exceed $2,500. Comparing quotes ensures you get the best rate for your needs.

Can My Credit Score Impact Car Insurance Premiums?

Yes, many insurers use credit scores to determine premiums. A higher credit score often leads to lower insurance costs. Poor credit may increase your rates because it suggests higher risk. Maintaining good credit can help reduce your car insurance expenses over time.

Does Car Insurance Cost Vary By State?

Car insurance costs vary significantly by state due to different laws and risk levels. States with higher accident rates or theft often have higher premiums. Also, minimum coverage requirements affect pricing. Knowing your state’s average helps set realistic budget expectations.

Conclusion

Car insurance costs vary based on many factors. Your age, driving history, and car type matter. Choosing the right coverage helps control expenses. Comparing quotes from different companies saves money. Regularly reviewing your policy keeps it up to date. Staying safe on the road lowers your rates.

Understanding costs helps you make smart decisions. Keep these tips in mind to find fair prices. Car insurance is important for protection and peace of mind.

Recent Posts

What to Do If Someone Hits Your Car: Essential Steps to Follow

Imagine this: you come back to your car and find it damaged. Someone hit your car.What do you do next? It’s easy to feel shocked, confused, or even angry. But staying calm and knowing the right...

Have you ever faced the frustration of a frozen car door on a cold morning? You’re not alone.When your car door won’t budge, it can throw off your entire day. But don’t worry—there are...